v2.33.0 YITH WooCommerce EU VAT, OSS & IOSS Premium [Original Version Number**] Activated

9,97 $

License key: 048d3f1a-28eb-4f69-8b2e-7d40b2e2eb7c

Email: [email protected]

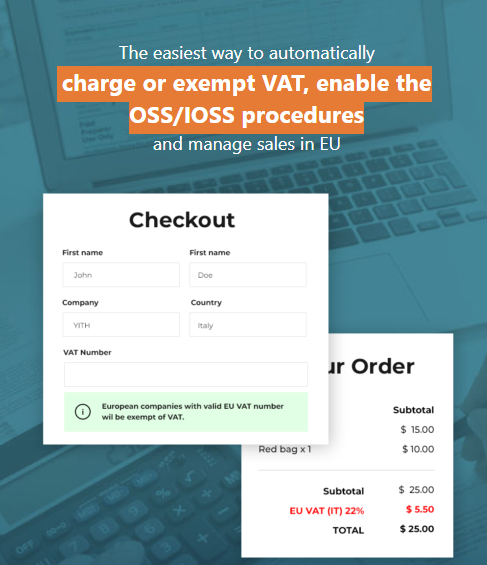

From January 1, 2015, the European Union has put into effect the new rules about the taxation on the purchase of digital goods (software, electronic, e-book, telecommunications and broadcast services) for European citizens.

In the business to consumer sale, the shop must apply the VAT of the country of the purchaser; while in the business to business, it all depends whether the company owns valid VAT number recognized by the European Union. 28 countries mean 28 different calculations; do you think it could be confusing? Well, because with YITH WooCommerce EU VAT everything will be automatic.